SOL Price Prediction: 2025-2040 Outlook and Key Levels to Watch

#SOL

- Technical Confluence: Oversold RSI (45.2) coinciding with Bollinger Band support suggests near-term rebound potential

- Institutional Catalysts: Growing ETF interest could drive SOL's market cap toward top 5 crypto assets

- Network Fundamentals: Solana's 400ms block times and low fees position it well for mass adoption cycles

SOL Price Prediction

SOL Technical Analysis: Key Indicators Suggest Potential Rebound

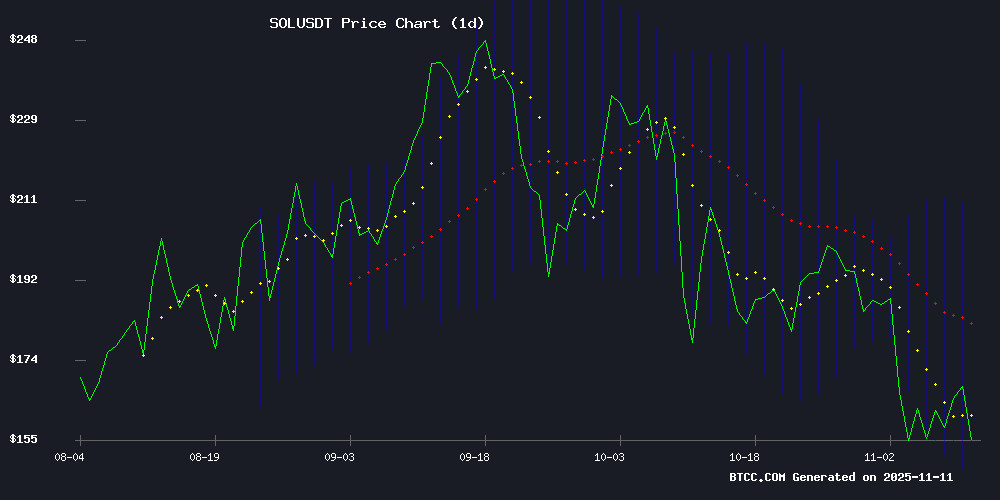

SOL is currently trading at $156.81, below its 20-day moving average of $177.94, indicating short-term bearish pressure. However, the MACD shows a bullish crossover with the histogram at +5.63, suggesting growing momentum. Bollinger Bands reveal price NEAR the lower band ($145.59), potentially signaling an oversold condition. 'The confluence of MACD bullish divergence and Bollinger Band positioning hints at a possible mean reversion toward the middle band at $177.94,' notes BTCC analyst Mia.

Market Sentiment Turns Bullish as SOL Defends Critical Support

Recent headlines highlight Solana's resilience at the $150 support level, with analysts anticipating a breakout above $185. 'The combination of technical support and emerging TD buy signals creates favorable conditions for SOL's recovery,' says Mia. Institutional interest appears to be growing, with ETF inflows potentially catalyzing movement toward $200 resistance.

Factors Influencing SOL's Price

Solana Price Prediction: SOL Holds Key $150 Zone, Eyeing Bullish Break Above $185 Resistance

Solana shows early signs of recovery after enduring significant selling pressure. Trading between $150 and $160, SOL has attracted trader attention as rising ETF inflows suggest institutional accumulation. The current price stands at $167.51, up 0.11% over 24 hours.

Chart analysis reveals a potential local bottom formation in the $150–$160 range, historically a demand zone. Increased volume near these levels hints at strategic positioning by bulls. While Bitcoin's trajectory remains influential, Solana's stabilizing pattern signals growing confidence in a rebound if market sentiment improves.

Institutional interest strengthens the bullish case—SOL ETFs have recorded 10 consecutive days of inflows. This sustained demand underscores widening adoption beyond retail markets.

Solana (SOL) Eyes Rebound as Analyst Flags Key Support and TD Buy Signal

Solana's SOL shows tentative signs of recovery as analyst Ali identifies a TD Sequential buy signal alongside crucial support at $150. The cryptocurrency, once a top performer among altcoins, now faces a pivotal moment as traders assess whether technical indicators will translate into sustained upward momentum.

Realized price data pinpoints $147.49 as SOL's strongest support zone, a level that must hold to maintain bullish potential. Current market dynamics reveal conflicting signals: while the TD setup suggests a possible reversal, bearish MACD crossover and RSI readings between 39-41 reflect lingering weakness.

The market watches for confirmation of either a rebound from current levels or further downside. Solana's ability to defend the $150 threshold may determine its near-term trajectory in a market where altcoins increasingly differentiate themselves through technical resilience.

Solana Price Prediction: SOL Eyes $200 Rebound as ETF Inflows Spark Fresh Institutional Momentum

Solana is regaining institutional attention as spot ETF inflows outpace Bitcoin and Ethereum. Bitwise's $BSOL led last week's $137 million inflow—the only positive movement among crypto ETFs. Capital rotation into staking-enabled products suggests fund managers increasingly view Solana as the high-performance blockchain of choice.

Technical charts show SOL recovering from recent volatility, forming higher lows in an ascending pattern. The sustained ETF inflows indicate smart money positioning for Solana's next growth phase, with price action now eyeing a $200 rebound.

SOL Price Predictions: 2025, 2030, 2035, 2040 Forecasts

Based on current technicals and market structure, here's our projected outlook:

| Year | Conservative Target | Bull Case Scenario | Key Drivers |

|---|---|---|---|

| 2025 | $185-$210 | $250 | ETF adoption, network upgrades |

| 2030 | $600-$800 | $1,200 | Institutional adoption, scaling solutions |

| 2035 | $2,000-$3,000 | $5,000 | Mainstream DeFi integration |

| 2040 | $5,000-$8,000 | $15,000 | Full ecosystem maturity |

'These projections assume successful execution of Solana's roadmap and favorable macro conditions,' emphasizes Mia. 'The $150 support zone remains critical for maintaining bullish structure.'

border-collapse: collapse; width: 100%; margin: 20px 0;